Building Member Trust With Loan Payment Skipping

Your accountholders may encounter financial challenges in meeting their obligations, especially those with high payment auto loans. Concerns about managing their monthly bills can also lead to a high amount of stress. In such situations, “skip-a-pay” services emerge as a potential solution for your accountholders.

Whether your accountholders seek additional financial flexibility or simply need some breathing room in their budget, offering the skip-a-pay program presents a valuable proposition, especially for those with personal loans. While skip-a-pay programs tend to garner heightened interest during significant occasions like major holidays and back-to-school seasons, it’s essential to highlight their year-round availability as a valuable resource.

- Key Considerations for Implementing a Skip-A-Pay Program

While each financial institution’s skip-a-pay program may have its unique features, several common factors should be taken into consideration:

Eligible Loan Types:

Decide which types of loans you will permit accountholders to skip payments on. Typically, skip-a-pay options cover personal and auto loans, with exclusions often including mortgages, home equity loans, credit cards, and new loans.

Frequency of Skipping Payments:

Define how frequently an accountholder can skip a payment. Usually, this is determined within a 12-month period to maintain fairness and consistency.

Processing Fee:

Consider whether you will impose a processing fee and, if so, its amount. Typically, these fees range from $20 to $40 per skipped loan payment.

Advance Notice Requirement:

Determine the minimum number of days before the due date that an accountholder must request a payment skip.

Becoming A Financial Life Saver For Your Accountholders

Skip-a-pay services offer several key advantages, enhancing your accountholders financial flexibility during costly periods or when facing temporary financial challenges. This flexibility allows them to allocate funds to more pressing needs, ensuring they can manage expenses more effectively.

Moreover, this service provides a vital layer of credit protection. By skipping a loan payment, your accountholders can maintain a positive payment history, safeguarding their credit score. Missing a payment can lead to a detrimental impact on your accountholders credit report, making the skip-a-pay option a valuable tool for preserving their creditworthiness.

Additionally, utilizing the Skip-A-Pay service can help them steer clear of new debt. This is particularly advantageous as it prevents the accumulation of additional debts and the associated interest, contributing to overall financial well-being.

Furthermore, for individuals burdened with high-interest debts, such as credit card balances, skipping a loan payment and redirecting those funds toward paying off these debts can lead to substantial long-term savings.

Lastly, but equally important, skipping a loan payment ensures that your accountholders won’t incur late payment fees, which can have an adverse effect on their finances, credit score and overall mental health.

Easily Provide Your Account Holders with Debt Relief or Extra Cash When They Need It.

Life Happens

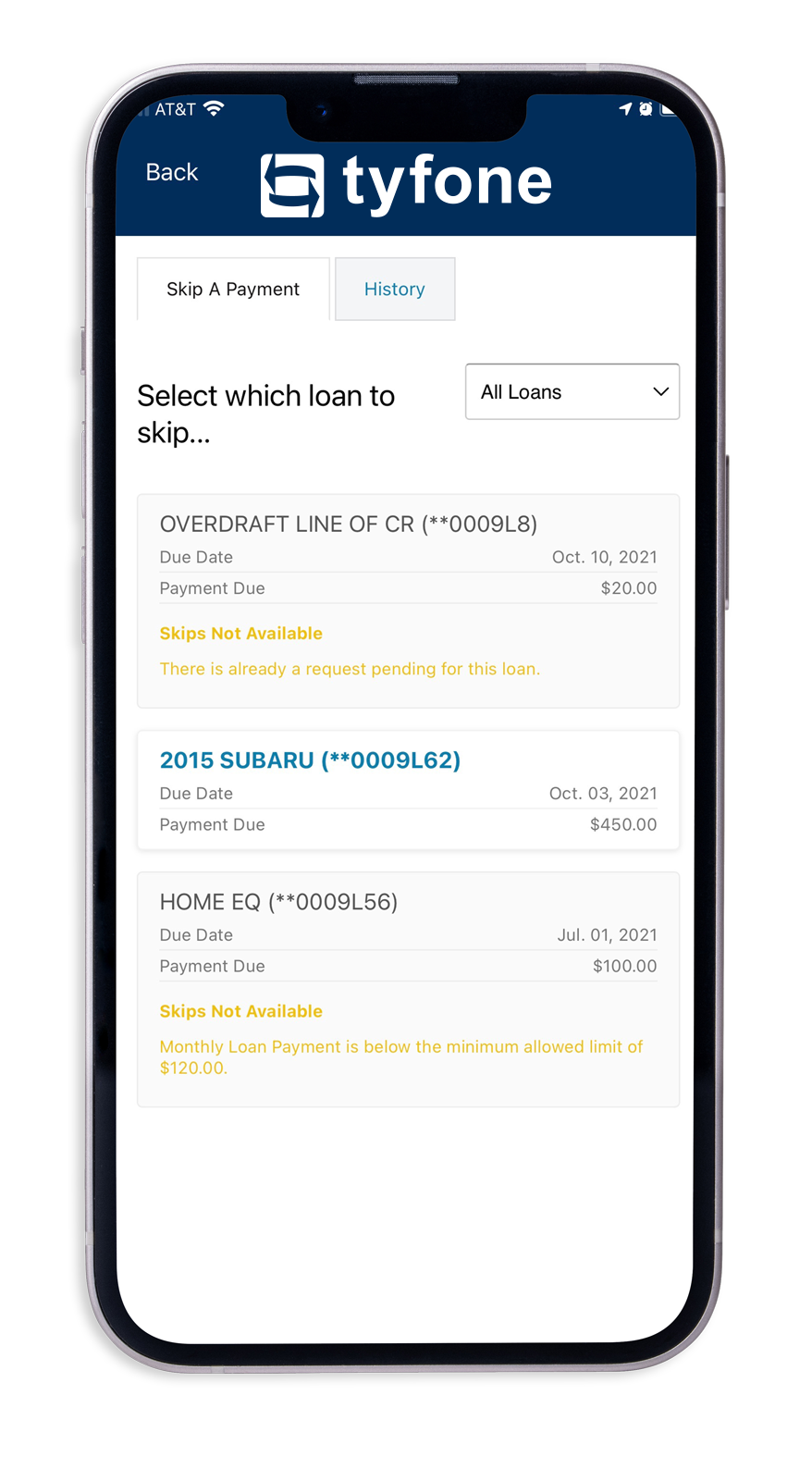

Your account holders want the flexibility, control and anonymity to skip their loan payments when they’re looking for financial relief. This process can be time-consuming, but with Tyfone’s Skip-A-Pay users can easily skip their payments.

Loan Payment Skips As An Alternative To Overdrafting

In recent years, overdraft fees have become highly profitable, with some banks earning over $9 billion in annual revenue from them. Despite this, a small fraction of accountholders generated most of these fees.

In the past few years, overdraft fee revenues at U.S. banks have significantly declined since their peak in 2019. Several factors explain this drop, including increased consumer deposits due to the pandemic and the influx of government stimulus funds. Moreover, consumer pushback, regulatory scrutiny, and competition from nonbank providers have prompted many banks, especially larger ones, to modify or eliminate their overdraft programs. More financial institutions now offer lower-cost alternatives that help accountholders cover account deficits while also meeting other financial goals, such as building credit.

Loan payment skips represent an alternative way to address the financial challenges faced by your accountholders. By offering the option to conveniently skip loan payments without any negative repercussions on their credit scores, you provide a valuable lifeline during times of need.

Not only do payment skips offer tangible benefits, but they also convey a powerful message to your accountholders: that your institution is there for them when they require critical financial relief. This perception of support fosters trust and loyalty among your accountholders, reinforcing your institution’s commitment to their financial well-being and enhancing their overall banking experience. It’s a win-win solution that strengthens your relationship with accountholders while offering them a practical way to manage their financial obligations more effectively.

Loan Skipping Made Easy With Tyfone

Avoiding loan payments can lead to inconvenience, resulting in feelings of embarrassment and a pressing need for prompt solutions. Additionally, financial institution staff members spend an average of 45 minutes due to system limitations like no automatic qualification, real-time due date changes, online payment deferrals, or the ability to skip payments through digital banking.

With Tyfone Skip-A-Pay, you can now provide debt relief to your accountholders the moment they need it. Skip-A-Pay enables your accountholders to effortlessly manage these tasks without even needing to log into your website.

This solution not only boosts accountholder satisfaction by offering year-round, loan payment skips that don’t affect credit score, but also dramatically eases your staff’s workload, saving them thousands of hours, all while generating additional revenue through skip fees.

Gone are the days of tedious manual and batch processing. Skip-A-Pay is applicable to all types of loans, and it offers a seamless integration, allowing you to place it anywhere on your website. This grants your accountholders effortless access without the need for digital banking login.

If you are looking for a flexible solution that can easily let your accountholders initiate loan skips from anywhere at any time, then Skip-A-Pay might be the right product for you. Click below to learn more.

Request A Pamphlet