Banking should be easy, fast, and built for the way people live today. nFinia gives your users a seamless, AI-powered experience with smarter tools, instant payments, and secure transactions.

Leading Financial Institutions Trust Our Solution

Supercharge User Experience With Penni AI

Powered by advanced AI and natural language understanding, Penni AI anticipates account holders’ needs, streamlines everyday banking tasks, and drives deeper engagement for financial institutions.

Conversational Banking:

Account holders can check balances, transfer funds, pay bills, and manage their accounts in a matter of seconds.

Instant Support 24/7:

No more waiting on hold, Penni answers questions and resolves issues in real-time.

Digital Engagement:

Increase app adoption and self-service usage with a seamless user experience.

Call Center Volume:

Penni AI reduces the need for human intervention. This minimizes call center volume, raising internal efficiency.

Redefining Banking with Radical Personalization

Radical personalization moves way beyond cosmetic customization by allowing verified users greater control over their banking experience, positioning financial institutions that embrace it as leaders in innovation and security.

- Protect your users from account takeovers (ATO) with a multi-layered defense, eliminating OTP errors and delays.

- Real-time alerts provide immediate push notifications for login or transaction requests.

- Ensure reliable authentication and transaction approval across all devices and operating systems.

- Give your account holders full control over trusted devices and let them easily manage their settings within your banking app.

Everything You Expect From Modern Digital Banking

AND SO MUCH MORE

While innovation is a key focus at Tyfone, our nFinia solution ensures your institution and account holders get all the essential features of a modern digital banking platform such as a seamless user experience, powerful integrations, smooth transactions, and easy account management.

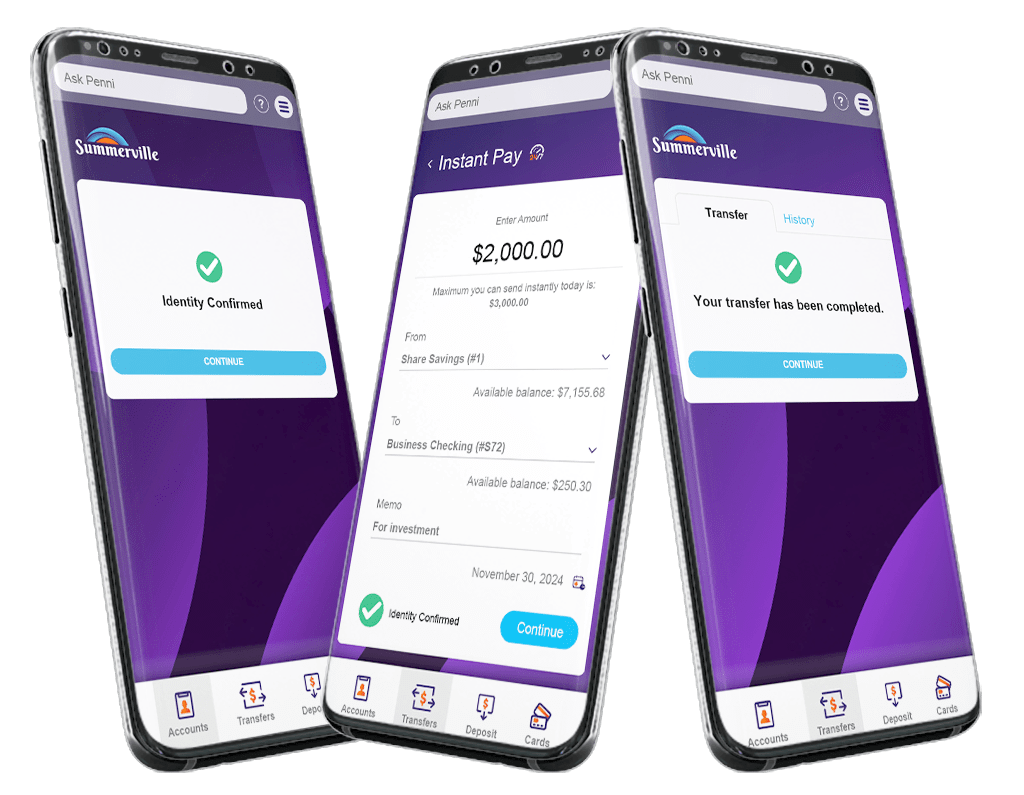

Get a glimpse of our platform’s look and feel.

Configurable Dashboard

Tyfone provides a configurable, intuitive, and user-friendly experience that sets your financial institution apart. Users can easily manage their accounts, view recent activities, monitor transfers, make payments, use advanced search options, discover new product offerings and enjoy ADA-compliant accessibility.

Alerts and Notifications

nFinia empowers banks and credit unions to communicate with their account holders through SMS, push notifications, and email alerts. These include balance changes, transaction activity, personal information updates, service outages, and payment reminders, ensuring users stay informed in real-time.

A truly open and agnostic approach working with any and all 3rd-party partners. Choose one of our partners, bring your own, or let’s work together to find the right partner for you.

- API driven

- 300+ native financial functions

- 200+ partner integrations

- Unlimited flexibility with your choice of third-party vendors

Ultramodern Architecture and Infrastructure for your Retail Banking Customers

To keep nFinia at the forefront of innovation, Tyfone leverages a sophisticated, open, and scalable platform, ensuring your retail banking members always benefit from cutting-edge technology.

Technology You Can Trust

Security is the foundation of trust in digital banking. Breaches can lead to loss of account holders and damage reputations. Advanced measures are essential to combat cyberattacks, data theft, and ensure compliance. A proactive security approach protects financial assets and builds confidence.

Tokenized Security

Minimize fraud without sacrificing convenience.

NIST V1.1 Compliance

We adopt a layered security strategy, implementing diverse security measures across all levels of the platform, ensuring a safe banking environment.

Weekly U.S DHS Threat Scans

The Department of Homeland Security’s (DHS) National Cybersecurity Assessments and Technical Services (NCATS) team conducts routine scans on a weekly basis.

20+ Patents In Authentication And Payments

This ensures our security procedures and technologies are consistently ahead of evolving cyber threats.

PCI-DSS 4.0 and SOC 2 Type 2 Certified for Top-Tier Security

Our security includes SOC 2 Type 2 certification, regular PCI-DSS scans by external auditors, along with tokenization, encryption, secure storage and transmission of PII/PFI data.

Customer Testimonials

Credit Unions and Banks nationwide partner with Tyfone to achieve strategic objectives, retain account holders, acquire new business, and turn their vision into reality.

Check out the videos below – their stories speak volumes about us!