Why credit union members should be cheering the strategic merger boom

The pace of consolidation in community banking has accelerated since 2020, as a confluence of factors continues to pressure small financial institutions. The recent period has brought (1) shifts in consumer preferences that demand maximum convenience and digital technology, (2) sophisticated fraud schemes and cybersecurity risks, and (3) increasing competition from nonbank financial institutions.

Meanwhile, the high cost of deposits and regulatory pressure on fee income puts additional strain on profitability.

Finally, the industry’s executive leadership is aging into retirement, forcing a difficult succession exercise in a tight labor market.

Naturally, these factors encourage consolidation, and the credit union industry is responding with dealmaking at a record pace. By the date of this article, the industry has announced 15 whole bank transactions in 2024, already surpassing the previous annual record of 14 such announcements (2022).

By dollar volume, credit unions also smashed the previous record, with total assets over $9 billion expected to be acquired in deals announced so far this year, compared to $5.15 billion across deals announced in all of 2022.

Credit unions are also quietly merging with each other more strategically than in the past. Historically, credit union merger activity tended to involve a merging credit union that (1) lacked scale to support full-service banking operations, or (2) suffered from poor financial condition, the inability to execute leadership succession, or lack of support from a primary sponsor.

Traditionally, mergers between credit unions with at least $100 million where the transaction was aimed at expansion of services rather than acute operating challenges have been rare exceptions. We refer to this type of transaction as a “strategic merger” for this discussion.

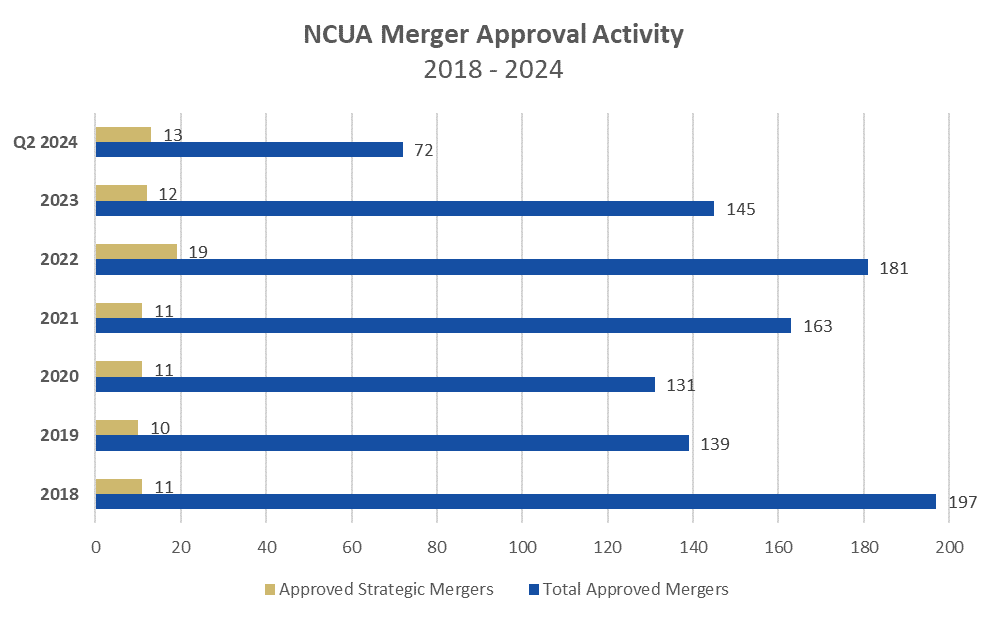

Examining the NCUA quarterly report of merger approvals, we observe a consistent level of strategic deal making in 2018 through 2021 – at a pace of about ten to eleven transactions per year. Strategic mergers account for about 6.8% of the overall merger activity during these years, with the highest annual contribution at 8.4% (2020). In 2022, there was a noticeable pickup in the number of strategic mergers (19), with a corresponding increase in the contribution of such dealmaking to overall activity at over 10%.

Source: National Credit Union Administration. Merger Activity and Insurance Reports.Q1 2018 – Q2 2024

In 2023, the merger activity slowed dramatically, in the wake of the failures of Silicon Valley Bank and Signature Bank, as credit unions turned their attention inward to respond to the complexities of a rapidly rising interest rate environment. The number of strategic mergers fell to 13 for the year.

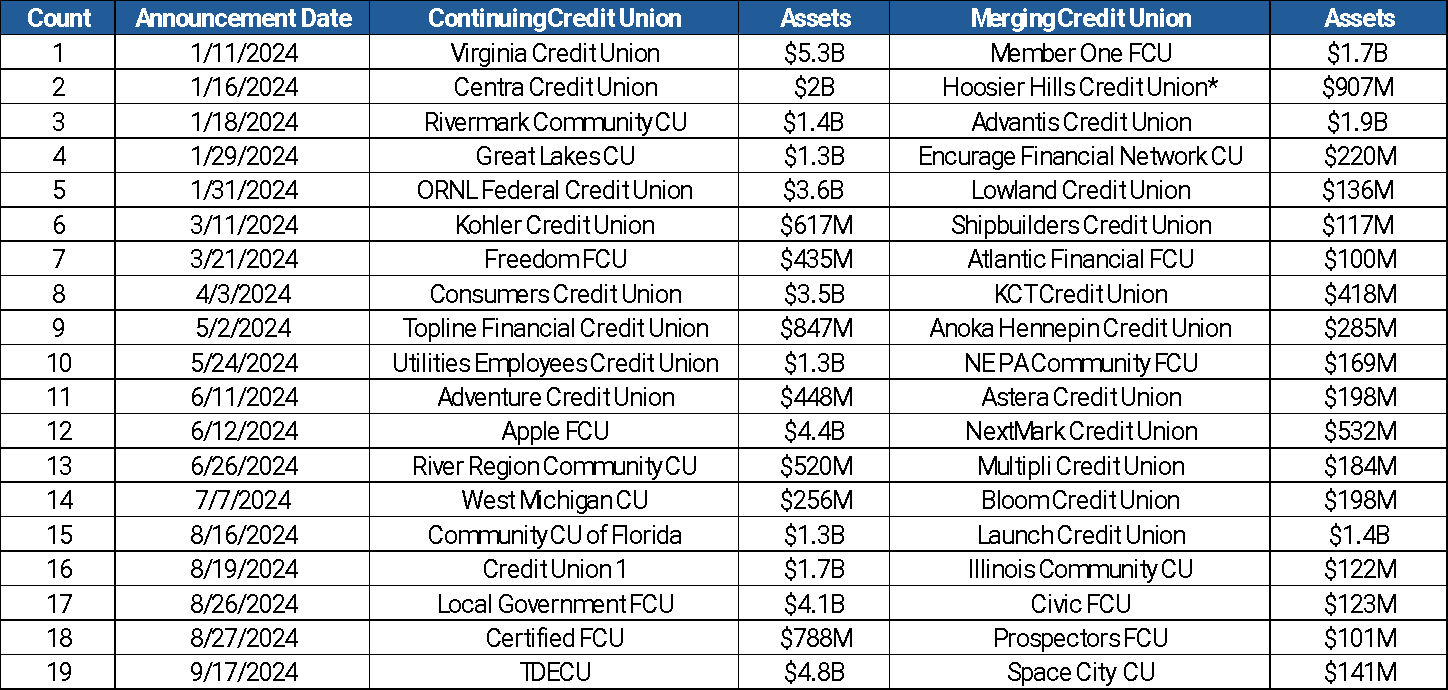

The strategic merger came roaring back in 2024. By mid-year, the NCUA has approved 13 strategic mergers, over 18% of all approved deals and already more than the NCUA approved all last year. By our count, 19 strategic mergers have already been announced year-to-date as of this writing.

* Member of Hoosier Hills CU defeated the proposed merger with Centra CU by vote on May 22, 2024

Critics of credit union mergers note that the merging credit union typically contributes its entire equity stack to the continuing credit union, turning the traditional merger transaction on its head. Essentially, the acquiree often pays its acquirer for the benefit of the deal rather than the other way around. By contrast, credit unions typically pay shareholders of an acquiree bank all its equity plus a significant premium.

Ironically, critics of credit union mergers insist that acquiring credit unions grossly under pay in such deals, which are typically perceived as practically free avenues of inorganic growth, albeit tricky to execute. Conversely, critics of credit union bank acquisitions insist that credit unions routinely overpay for such deals boosted by their tax exemptions.

The absence of objective value for credit union members in typical mergers is notable in instances where strategic mergers have been voted down by members in recent years. Most notably, members of Hoosier Hills CU with over $900 million in assets rejected its proposed merger with $2.2 billion Centra Credit Union in May 2024, tanking one of the largest strategic mergers announced this year.

Last year, members of $234 million St. Lawrence FCU similarly rejected a proposed merger with $806 million SeaComm FCU. In 2022, members of $246 million InFirst FCU defeated a proposed strategic merger with $468 million Arlington Community FCU.

In none of these deals were any merger-related dividends incorporated for the benefit of the merging credit union’s members.

As consolidation in the marketplace heats up, so will competition for deals. We are already seeing the typical premiums paid by credit unions in bank acquisitions drifting higher. The gap between the typical acquisition price in a bank transaction versus a credit union merger ought to narrow. We believe it will as more credit unions think strategically about mergers and realize the benefits of them relative to bank acquisitions.

This would be a welcome development for members of merging credit unions who stand to realize in future deals material portions of the retained earnings built up in their credit union in the form of merger-related dividends. Such a price compares favorably to that paid in a comparable bank acquisition for acquirers but will provide objective value to the acquiree’s members, often as much as several hundred dollars on average.

Not bad consideration for joining a larger credit union that ostensibly provides expanded services and greater capabilities.

Daniel Prezioso is a partner at Olden Lane – a boutique financial services firm dedicated to the credit union industry.

Disclaimer

The views, opinions, and perspectives expressed in articles and other content published on this website are those of the respective authors and do NOT necessarily reflect the views or official policies of Tyfone and affiliates. While we strive to provide a platform for open dialogue and a range of perspectives, we do NOT endorse or subscribe to any specific viewpoints presented by individual contributors. Readers are encouraged to consider these viewpoints as personal opinions and conduct their own research when forming conclusions. We welcome a rich exchange of ideas and invite op-ed contributions that foster thoughtful discussion.