How Inaccessibility Harms Disabled Account Holders

Digital inaccessibility has a profound impact on disabled users, constraining their options when it comes to choosing the right financial institution. According to the Census Bureau, approximately 14% of the U.S. population has a form of disability.

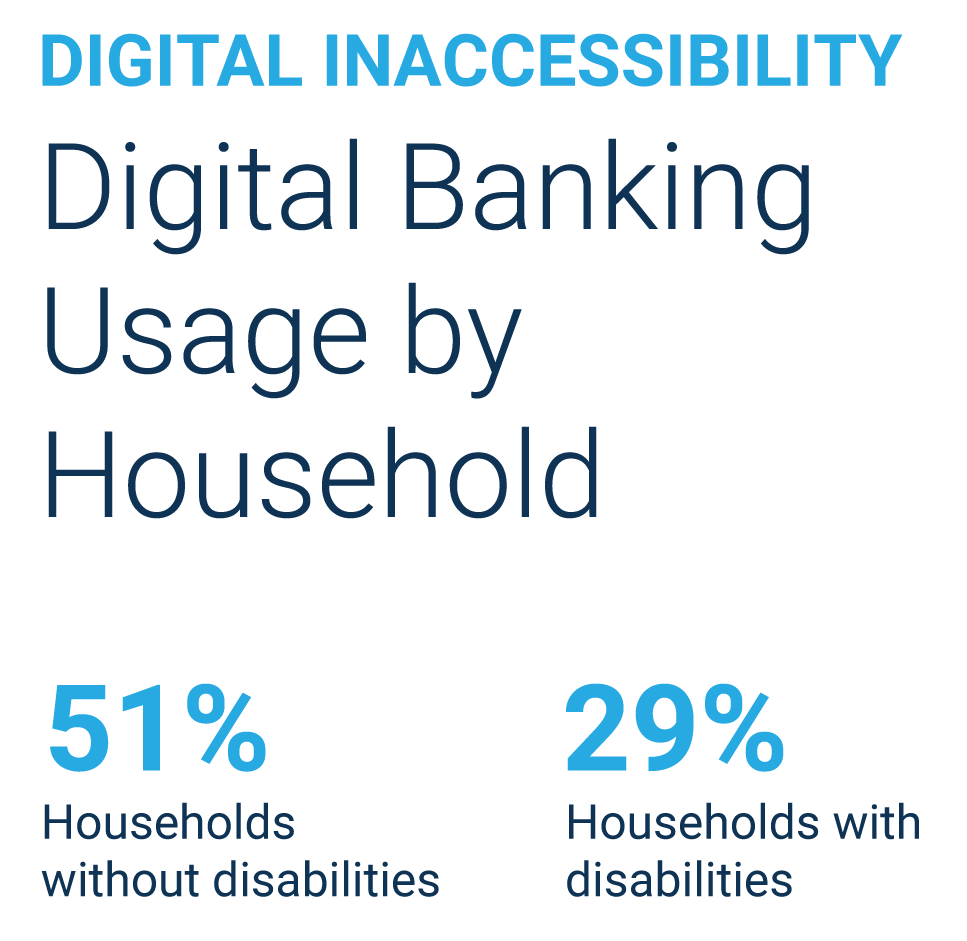

The National Disability Institute reports a significant contrast in digital banking usage between households with and without disabilities. Less than half of households with disabilities access their accounts online, with a mere 29% utilizing digital banking. In comparison, 73% of households without disabilities access their accounts online, and 51% use mobile banking.

Financial services that lack digital accessibility force disabled users into managing their finances in person, resulting in not only inconvenience but also emotional impact arising from the sense of being treated differently.

The Benefits Of Accessibility In Digital Banking

Ensuring digital accessibility in banking is crucial for creating an inclusive financial environment. Let’s look at some of the benefits that come with providing an accessible digital experience.

Better User Experience

Accessibility significantly enhances user experiences. People with disabilities face fewer barriers when digital platforms support features like screen readers, text-to-speech technologies, and keyboard navigation. For instance, 40% of banks lack accessibility, meaning there are many users with disabilities who struggle daily with inaccessible financial websites, often needing assistance from others.

Market Reach

Accessible banking services expand the market reach for financial institutions, allowing them to appeal to a broader audience, including people with disabilities. This not only fosters inclusivity but also enhances customer satisfaction and loyalty (Private Banker International).

Operational Efficiency

Digital accessibility can streamline back-office operations by reducing the need for customer support related to accessibility issues. Enhanced reporting capabilities can assist institutions with understanding user behaviors and preferences, leading to better service delivery.

Social Responsibility

Promoting digital accessibility showcases a commitment to social responsibility and community engagement. It ensures that all users, regardless of their physical or cognitive abilities, can manage their finances independently, which is a fundamental right.

How To Enable Inclusive Banking

In today’s digital age, accessibility and ADA (Americans with Disabilities Act) are becoming very important for the majority of financial institutions. Providing an inclusive banking experience from the get-go not only adheres to regulatory guidelines but also reflects the financial institution’s commitment to serving a diverse clientele.

Inclusive banking is very important for a number of reasons that can be seen below.

1

Inclusivity and Customer LoyaltyCreating an accessible banking experience makes it easier for individuals with disabilities and seniors to interact with your institution. This approach not only improves customer loyalty across your user base but also enhances your account holder’s overall user experience.

2

Meeting Regulatory Standards3

Simplifying AccessibilityWhile achieving web and mobile app accessibility may seem like a daunting task, it can be simplified by choosing the right digital banking solution provider. Your choice of technology can make a significant impact on your ability to accommodate various customer needs.

FREE PAMPHLET

Unlocking Inclusive Banking Through Accessibility

Explore our pamphlet to see how Tyfone supports disabled account holders by delivering a modern, user-friendly experience. Discover our commitment to building an inclusive and accessible digital banking platform that empowers everyone to manage their finances with ease. Learn more about the impact of providing accessible digital banking to disabled account holders and the reasons why inclusion is so important in today’s society.

Harmonizing Software Design With Compliance

Our commitment to offering an inclusive digital banking solution is part of our core design philosophy, ensuring that innovative features and products are accessible to users of all abilities. This is the reason that Tyfone’s followed the four WCAG principles when designing the nFinia platform:

- Be Perceivable: All users should have the ability to perceive any and all information that appears on your website. That includes things like text, images, videos, and so on.

- Be Operable: Any user should be able to utilize every feature and tools offered by the company.

- Be Understandable: Aside from being able to “view” a website and navigate through it, users also need to be able to understand what they’re reading, listening to etc.

- Be Robust: Don’t shorten descriptions, directions, and explanations. All users should be treated the same by providing them with the full user experience.

Tyfone’s goal is to create harmony and trust between financial institutions and their account holders. Our comprehensive approach assures that the nFinia banking platform is accessible and accommodating to users of varying abilities, enhancing their overall user experience and ensuring that banking services are readily available to all.

We are proud to say that we are ADA compliant and WCAG 2.2 AA compliant. Our banking platform seamlessly adapts to web and mobile environments, and we harness cutting-edge technologies, including voice assistants, to provide accessible banking services for as many people as possible. Accessibility is extremely important to us, so we make it our priority to go above and beyond what’s asked of us and make digital banking easily accessible by everyone.

“Accessibility in technology isn’t just a choice for Tyfone, it’s integrated in our way of thinking. By creating accessible financial software, we are building a bridge that connects innovation to inclusion, empowering those with disabilities to navigate the digital landscape with equality.”

– Siva Narendra

CEO

Tyfone

How The nFinia Platform Is Perceivable

In order to ensure an inclusive and user-friendly digital banking experience, Tyfone implements several initiatives.

These include using straightforward language to avoid complex technical jargon, providing alternative text instructions for form fields, offering numbered and clearly defined steps for complex tasks.

Our solution also helps the end user quickly resolve any outstanding issues by displaying contextual error messages and information markers, presenting descriptive remedy options and designing screen reader friendly forms with easy to understand labels.

Recognizing the diversity in how users perceive information, we present content in both visual and non-visual formats, catering to different needs.

Our comprehensive approach assures that the nFinia banking platform accommodates users of varying abilities, enhancing their user experience and ensuring that banking services are readily available to all.

How The nFinia Platform Is Operable

Creating an easy-to-use interface is essential in providing an accessible user experience. Our interface prioritizes keyboard operability, making it screen reader-friendly, with seamless navigation using tab and arrow keys.

To accommodate user needs, we offer configurable time limits for session expiration and other time-sensitive actions. Users will receive a countdown warning before their session times out, with the option to extend the time limit.

We also provide alerts that do not auto-disappear, guaranteeing information remains accessible. Our commitment to accessibility also means there is no flashing content anywhere in our interface, promoting a safe and comfortable browsing experience for all users.

Our digital solution can also be completely operated by using just one hand, and every element on the screen is thumb friendly. Our interface is designed to be responsive, seamlessly adapting to different devices and resolutions without disrupting the flow of information.

Finally, our solution can be viewed in both landscape and portrait orientation.

How The nFinia Platform Is Understandable

To ensure a user-friendly solution, we use clear and simple language, avoiding technical jargon, to present information at easily comprehensible reading levels. We also showcase every icon with text below it to make sure every item in the platform is easy to understand.

For form fields, we provide alternate text instructions to aid users in completing them accurately. Complex tasks are broken down into clear, numbered steps, providing users with reassurance as they navigate the platform. All forms come with clear labels and additional instructions that are screen-reader friendly, promoting an inclusive experience.

Contextual error messages, help prompts, and information markers are integrated with our product to assist users in real-time.

To effectively manage user errors, we provide clear and concise solutions. Furthermore, we enhance the user experience by incorporating confirmation screens, minimizing the chances of mistakes during critical actions.

How The nFinia Platform Is Robust

At the heart of our company lies a commitment to delivering a user experience that is both robust and intuitive. We achieve this by offering a range of tools to assist users in effortlessly navigating our platform. These tools include well-structured menus, easily identifiable text links, and a keyboard-driven page navigation system that allows for flexible exploration.

To enhance accessibility even more, we use large navigation icons and buttons, carefully designed to maintain clarity with a high-contrast ratio between background and foreground, ensuring they remain differentiated even when desaturated.

Additionally, we prioritize accessibility through the use of text-based links and providing text alternatives for non-text links.

Finally, our tab-ordered keyboard navigation facilitates a logical and sequential movement within pages, promoting user efficiency. Keyboard focus indicators and clear headings are thoughtfully integrated to provide guidance.

Delivering A Future-Proof Solution For Every Account Holder

Leading financial institutions nationwide partner with Tyfone to achieve strategic objectives, retain account holders, acquire new business, and turn their vision into reality.

In contrast to legacy systems that only offer visibility of the past and present, Tyfone is dedicated to providing your account holders with a forward-looking perspective. Our vision of the modern digital banking experience extends beyond just balance checking or bill payments. We consider our digital banking platform as an extension of the financial institution, empowering account holders to comprehensively manage their entire financial lives.

Tyfone’s robust digital banking solution capitalizes on the vast potential of digital channels, delivering tailored and easily accessible services to users of all ages and abilities.

Our solution makes it easier for financial institutions to reach out to accountholders, irrespective of their location or what they are doing. Being inclusive is no longer an option and is mandated as a best practice both by technology and regulations.

What sets Tyfone apart is our passion and commitment to exceeding user expectations.

We always strive to provide a digital banking experience that is not just powerful but user-centric. If you are looking for a partner that is committed to collaborating with you to achieve your specific goals and vision, start a conversation with Tyfone today.