Next-gen authentication without the hassle.

Introducing Cryptographic Device Authentication (CDA) in nFinia Digital Banking; a way to bind trust to the device itself using advanced cryptography that’s seamless for the user and nearly impossible for attackers to replicate.

Digital banking is no longer optional but essential. Financial institutions are under increasing pressure to strike a balance between user convenience and security. The stakes have never been higher.

Account takeover fraud is growing, SIM swapping has become a common attack vector, and phishing scams are more targeted and convincing than ever.

Yet most institutions are still leaning on decades-old defenses: passwords, one-time passcodes (OTPs), security questions. Even multi-factor authentication, long considered a gold standard, often depends on outdated delivery methods like SMS, which are vulnerable to interception and manipulation.

Cryptographic Device Authentication (CDA) from Tyfone is an elegant, forward-looking solution built right into nFinia Digital Banking.

What is Cryptographic Device Authentication?

Cryptographic Device Authentication replaces fragile and phishable authentication factors with something far more secure: a cryptographically unique identity for every device.

Instead of relying on a code sent via text or an app-generated token, Tyfone’s CDA leverages public-key cryptography to verify that the device requesting access is one that’s already been enrolled, verified, and trusted.

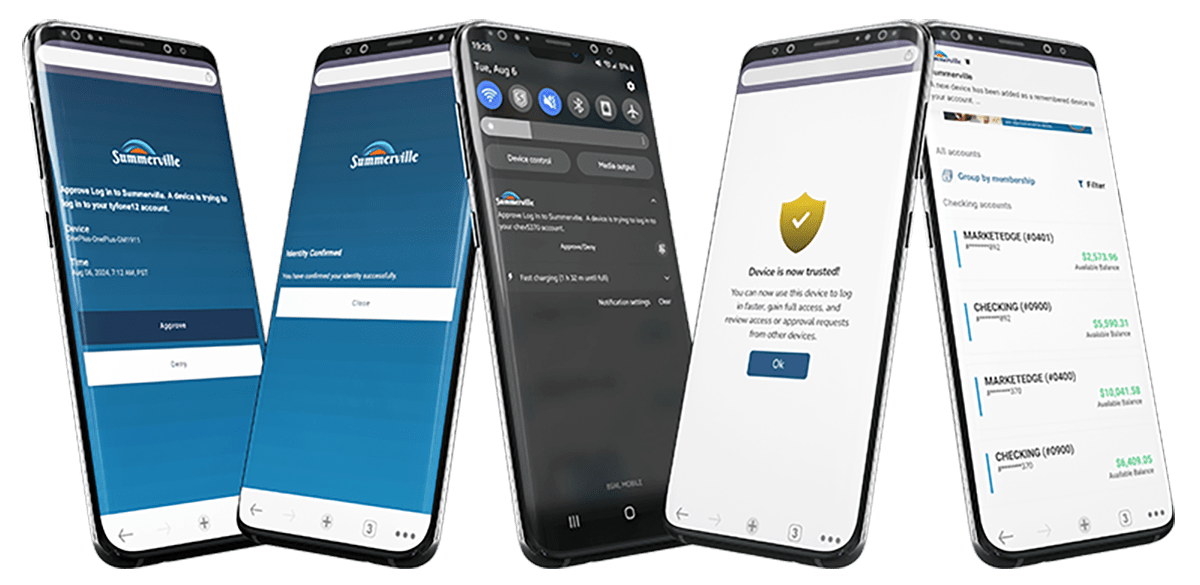

Here’s how it works under the hood:

- During the initial device registration to a platform, a unique key pair is generated, one private, one public.

- The private key is stored securely on the device.

- When someone tries to log in or do something sensitive, the platform sends a quick ‘prove it’ request to their device.

- The device answers by creating a unique, tamper-proof signature with its secret key. The server then checks that signature using the matching public key to make sure the device is genuine.

Because the private key never leaves the device, this process guarantees the device’s authenticity without needing fragile credentials or time-limited codes.

To the end user, this authentication process is completely invisible. They simply open the app, authenticate as usual (biometrics, passcode, etc.) and get access, while CDA works silently in the background to protect their session and identity.

Built into nFinia: A security layer that just works.

Our CDA solution is woven directly into the nFinia digital banking platform, powering authentication, session integrity, and device validation from the inside out.

Financial institutions gain not only stronger protection but also greater peace of mind, knowing their security is built on a foundation they can trust.

- Invisible Security: Because it doesn’t rely on user behavior (like checking text messages), CDA eliminates friction while strengthening defense.

- Cross-Platform Consistency: Whether your members use Android, iOS, or Web, CDA enables a consistent level of security across all endpoints.

- Zero OTP Dependency: Eliminates the risks and delays associated with SMS- or email-based one-time passcodes.

- Device-Rooted Trust: Makes it incredibly difficult for fraudsters to spoof devices, even if they’ve stolen login credentials.

Easier Support: Reduces the number of support tickets related to login problems, expired codes, or device changes.

Why CDA matters more than ever:

Nowadays, static passwords and out-of-band authentication no longer cut it. Cybercriminals have evolved. SIM swapping is now industrialized, credential-stuffing bots hammer millions of login attempts every hour, and phishing emails have advanced from clumsy scams to AI-crafted replicas of real bank communications.

What these attacks have in common is a reliance on stolen or intercepted information. But CDA changes the game: it removes the ability to authenticate from stolen credentials alone.

Without access to the original, trusted device, and more specifically, without the private key stored on that device, fraudsters can’t get in.

While security is critical, member experience remains a top priority for every financial institution.

In fact, it’s often seen as a tradeoff. Tighten security, and you’ll lose convenience; loosen it, and you invite risk.

CDA helps dissolve that narrative.

Because it operates silently in the background, CDA actually removes steps from the authentication flow. There’s no waiting for a text message, no switching between apps, no copy-pasting of codes.

Members don’t even realize a high-assurance authentication process has taken place, yet behind the scenes, your systems have just verified the device cryptographically and with confidence.

For the institution, this means fewer drop-offs, happier users, and fewer support calls. For the member, it means the same convenience they’ve come to expect from big tech, without the risks those platforms often accept as the cost of scale.

Cryptographic identity is the future of digital access.

As digital banking continues to evolve, the next wave of innovation won’t always come from adding flashy features or redesigning dashboards. It will come from redefining how trust is established between users, devices, and systems.

And as more institutions adopt Zero Trust models, enforce continuous authentication, and migrate to passwordless strategies, solutions like CDA won’t just be nice-to-haves, they’ll be essential.

The question isn’t whether you can afford to implement cryptographic device authentication.

The question is: can you afford not to?