Transforming banking with digital New Account Opening.

For decades, opening a new bank or credit union account meant stacks of paperwork, in-branch visits, and long wait times. But today’s consumers expect something entirely different: instant access, seamless digital experiences, and the ability to get started anytime, anywhere.

Unfortunately, many financial institutions are still playing catch-up and the challenges they face are holding them back from delivering the kind of modern experience members expect.

The challenges financial institutions face:

- Outdated, branch-dependent processes:

Many banks and credit unions still rely heavily on in-person onboarding. Without digital identity verification or e-signature capabilities, staff must handle physical documents, perform manual ID checks, and require wet signatures on forms. This creates long wait times and unnecessary friction that discourages prospects from completing the process. - Rising member expectations and drop-offs:

We live in an instant world. People can order groceries, stream entertainment, and schedule rides with a few taps on their phone. When it comes to financial services, they expect the same ease.

Long applications, limited branch hours, and slow approvals often result in applicants abandoning the process altogether. Every drop-off represents not just a lost account, but a lost long-term relationship. - Operational inefficiency and compliance pressure:

Manual workflows put a heavy burden on staff. Employees must process paperwork, run compliance checks, and chase down missing documents. This slows everything down, increases operational costs, and leaves more room for human error.

At the same time, compliance requirements around KYC, AML, and fraud prevention are only becoming stricter, making it riskier for institutions to rely on outdated methods. - Lack of personalization:

Traditional account opening is often one-size-fits-all. Whether it’s a new member or an existing one, a primary account or a joint account, the process rarely adapts. This rigidity makes applicants feel like just another number rather than a valued individual, missing an important opportunity to build loyalty from the very first interaction.

These four challenges, legacy processes, consumer expectations, inefficiency, and lack of personalization form a serious barrier to growth.

Without modernizing, financial institutions risk losing prospects, straining staff resources, and falling behind competitors.

Manual vs. digital account opening:

The difference between manual and digital account opening is stark. Traditional methods are slow and inconvenient, often requiring multiple in-person visits, stacks of paper forms, and long waits for verification. They are bound by branch hours and limited by staff capacity, leaving applicants frustrated by the lack of flexibility. Compliance checks and document reviews are time-consuming, increasing the chances of errors while driving up costs. Security, too, is weaker in a paper-based environment, where physical documents can be mishandled or tampered with.

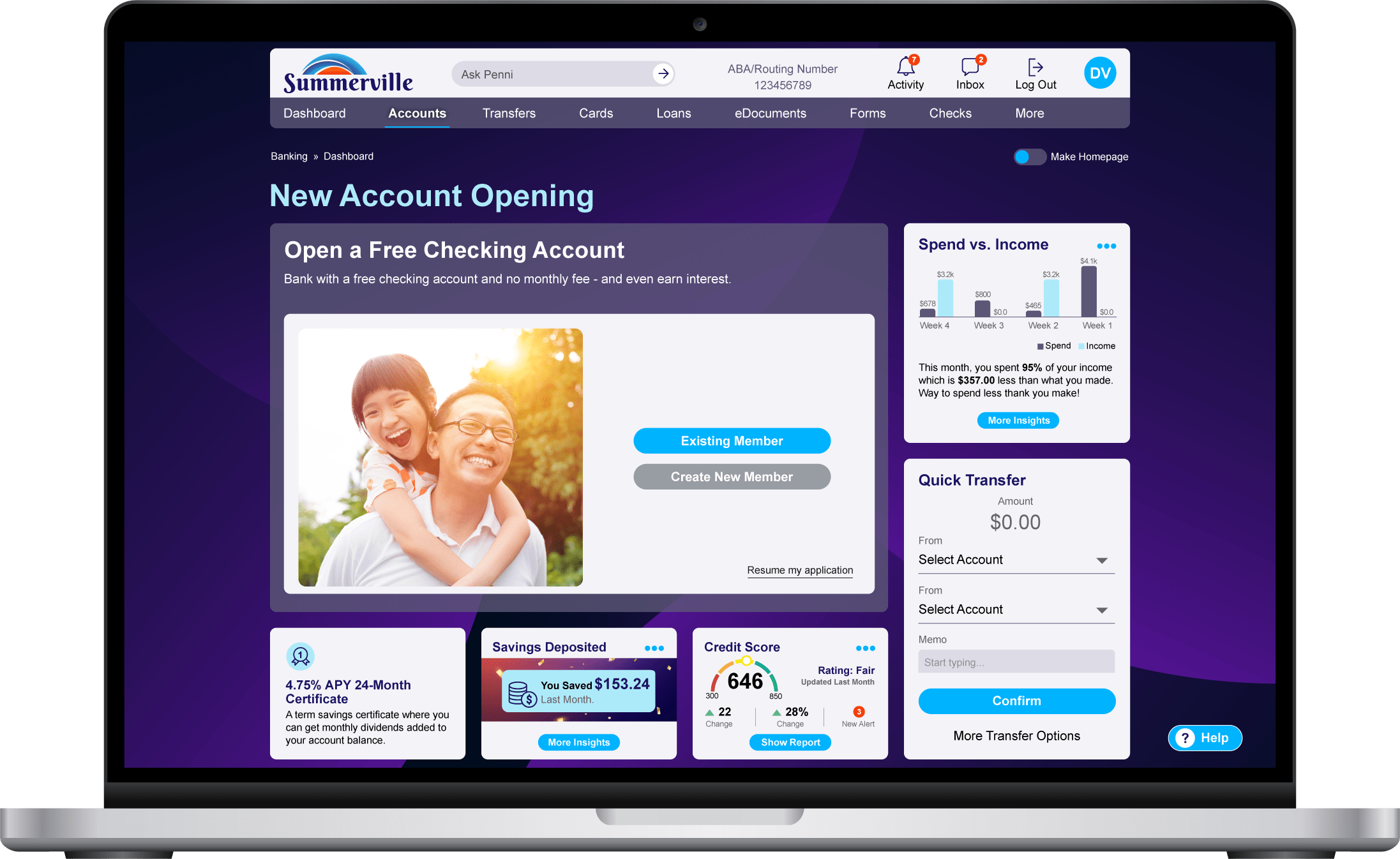

Digital account opening flips this experience on its head. Instead of waiting in line, members can open accounts anytime, anywhere, on any device. Applications move quickly thanks to automated workflows, and compliance checks run seamlessly in the background, reducing both risk and effort. The digital process scales effortlessly, handling high volumes of applications without adding strain on staff. Security is also stronger, with features like encryption, multi-factor authentication, and biometric ID verification. Most importantly, the experience feels personalized. Applicants are guided through an intuitive, streamlined flow that adapts to their situation, making the process not only faster and safer but also more human.

Benefits for financial institutions:

For banks and credit unions, a digital NAO solution is more than a technology upgrade, it’s a strategic growth driver. Institutions gain:

- Higher conversion rates:

Streamlined, mobile-friendly flows reduce application drop-offs and turn more prospects into active members. - Lower operational costs:

Automation eliminates repetitive manual work, freeing staff to focus on higher-value tasks and reducing the need for extra headcount. - Scalability:

A digital platform can handle large volumes of new accounts without adding strain to branch staff or operations teams. - Stronger compliance & security:

Built-in KYC, OFAC, and AML checks help institutions stay compliant and reduce fraud risk, all while protecting member trust. - Data-driven insights:

Reporting and dashboards give executives and staff visibility into bottlenecks, funding trends, and campaign performance, helping refine growth strategies.

In short, a modern NAO platform helps financial institutions grow deposits, operate more efficiently, and stay competitive in a market where consumers have more choices than ever.

Benefits for members:

The difference for members is just as significant. Instead of taking time off to visit a branch, they can complete the process anytime, anywhere on their phone, laptop, or tablet. They can start an application, pause, and pick it up later without losing progress.

Multiple funding options like debit cards, ACH transfers, or internal transfers give them flexibility. And because the process is personalized, they may receive relevant recommendations for add-on products or services that fit their needs.

Most importantly, digital onboarding builds trust right away. When members see that the institution values their time, offers security, and delivers a smooth experience, they feel confident starting their financial journey there.

Driving growth with marketing and integrations:

Digital account opening is more than a back-office efficiency tool. It’s also a powerful growth engine. With Tyfone’s New Account Opening solution, the process itself becomes an opportunity to engage new members and strengthen their connection to the institution.

Built-in marketing capabilities allow financial institutions to capture the context of where applicants are coming from, whether through a Facebook campaign, an Instagram promotion, or a personalized email.

Instead of a one-size-fits-all experience, institutions can deliver relevant messaging, nurture deeper engagement, and even present personalized product recommendations during onboarding. What was once a transactional step is transformed into a tailored, relationship-building interaction.

Tyfone also enhances account opening with optional integrations that add security, insight, and convenience. Soft credit checks from Experian provide additional verification without adding friction. Services like FIS Qualifile and ChexSystems enrich risk analysis by evaluating deposit history, debts, and disputes.

Real-time support is made possible through partners like Glia, where staff can step in with video chats or co-browsing to guide applicants through the process. And with integrations such as Yodlee, external accounts can be instantly verified, ensuring that funding is fast, seamless, and secure.

Together, these features position Tyfone’s New Account Opening as a comprehensive solution, one that builds trust, reduces risk, and empowers financial institutions to meet applicants with confidence from the very first interaction.