California credit union to enter the insurance space through agency launch

Meriwest Insurance Services is set to launch in the fourth quarter of 2025 and should provide the $2.1 billion-asset credit union with enhanced member relationships.

Credit Unions’ efforts to diversify their revenue streams while building cross-selling opportunities can take many forms.

For the $2.1 billion-asset Meriwest Credit Union, those things will materialize as a new, full-service insurance agency.

The San Jose, California-based Meriwest announced last week that Meriwest Insurance Services is set to launch in the fourth quarter of 2025 and “reinforces the credit union’s commitment to delivering innovative financial solutions” to its 80,000 members.

“We can provide our members with convenient, competitive, and reliable insurance solutions to help meet their needs at a time when insurance costs are rising rapidly,” said Lisa Pesta, President and CEO of Meriwest Credit Union, in a press release.

Other credit unions have entered the insurance game through an acquisition.

For example, Hanscom Federal Credit Union in Littleton, Massachusetts, in late 2024 acquired the $300 million-asset Peoples Bank in Chestertown, Maryland. That deal included Peoples Bank’s insurance agency subsidiary, Fleetwood Insurance Group.

In 2023, Achieva Credit Union in Florida bought Cannella Insurance Services, a 900-client firm based in Tampa.

Story continued below…

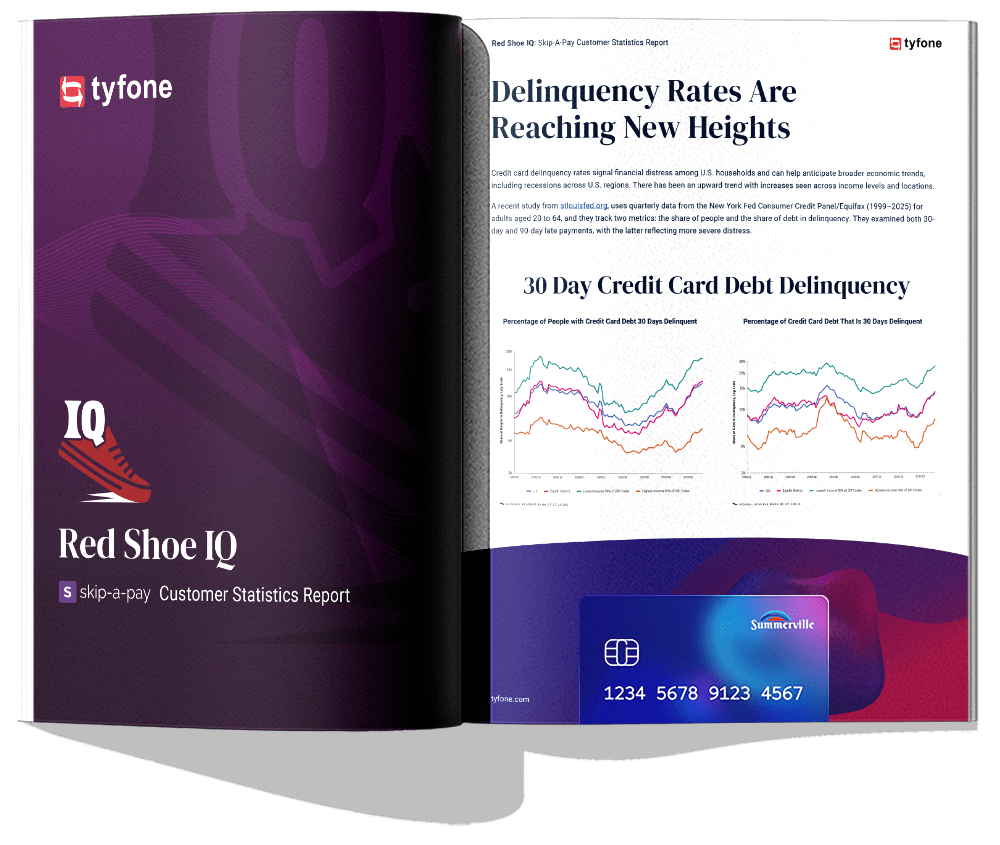

FREE PAMPHLET

Red Shoe IQ:

Skip-A-Pay Customer Statistics Report

Inside this report you will find statistics on 30-day and 90-day debt delinquency across the U.S., comparison of loan skips and yearly revenue from loan skip fees across our customers, loan skips by institution asset size and number of members, and more!

Many insurance agencies are family/founder-owned and are increasingly interested in a financial partner that can provide liquidity for owners and a differentiated distribution platform, says Russ Hunt.

“Credit unions are a great fit to meet those trends. Smaller independent [agencies] operate with a business model and customer approach much like credit unions – namely serving small business and families in a defined community,” he said.

Credit unions are known for their member-centric approach, and by offering insurance and investment services, they can deepen relationships with members.This holistic approach can lead to increased member satisfaction and retention, according to Hunt.

Meriwest Insurance Services will offer a broad range of insurance products, for individuals, families, small businesses, professionals and non-profits.

Meriwest Credit Union earned $602,000 in the first quarter of 2025, a 58% increase compared to the year-ago quarter, according to call report data from the National Credit Union Administration.

The credit union in May completed a $9.6 million transaction to acquire a property directly adjacent to Meriwest’s headquarters that positions the company to develop a cohesive “campus.”

“We can provide our members with convenient, competitive, and reliable insurance solutions to help meet their needs at a time when insurance costs are rising rapidly.”

– Lisa Pesta

President and CEO

Meriwest Credit Union