New NCUA chairman addresses “crazy” rumors circulating about the regulator

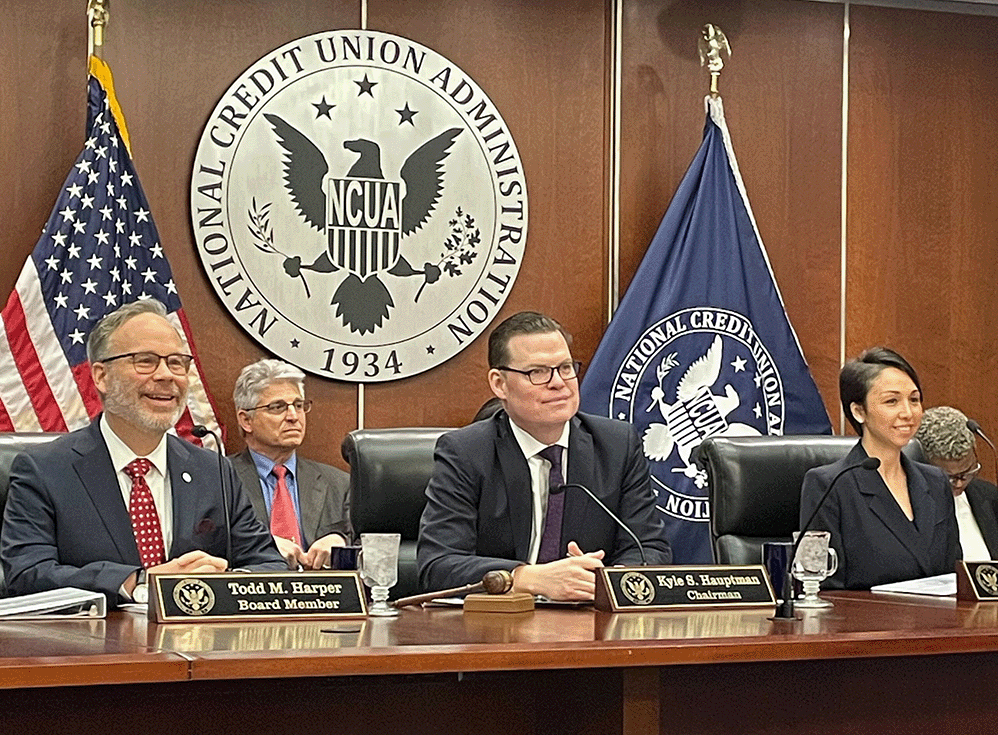

During his first meeting as chairman of the National Credit Union Administration, Kyle Hauptman encouraged NCUA employees and consumers not to believe everything they read.

While admitting that they are as uncertain about the exact future of the agency as anyone, the National Credit Union Administration board moved quickly to quell growing concerns among its employees and the nation’s credit unions.

It has been widely reported that President Donald Trump is seeking a path to combine some of the agencies that regulate U.S. financial institutions – possibly including the NCUA.

At the agency’s monthly board meeting Thursday, NCUA Chairman Kyle Hauptman acknowledged that during the past few weeks there have been a flurry of executive orders signed by the President that are impacting the federal workforce, including the NCUA.

He said some of those directives may ultimately bring changes to the agency.

“All of us at the NCUA – including the board – are diligently assessing how these announcements may impact NCUA, our operations, regulatory structure and our workforce,” Hauptman said.

It was the first board meeting chaired by Hauptman, and Tyfone was in attendance in advance of the America’s Credit Unions’ Governmental Affairs Conference, which kicks off in Washington D.C. later this week.

Hauptman also cautioned that there is a lot of misinformation and wild rumors floating around about potential changes to the agency and the credit union system overall.

“I spent some time recently reading forums on Reddit that touch on NCUA or federal employees, and there is some crazy stuff out there,” he said. “There are people moving their money out of banks and credit unions. They think federal deposit insurance is going away, and that’s not even one of the crazier [rumors] out there.”

He said any of the 1,200 employees at the agency are free to reach out to him at any time with questions or concerns.

“While we on the board don’t have any more info on White House directives than anyone else, I’m happy to talk to you about problems and possible solutions. I’ll tell you what I know and don’t know,” he said.

Hauptman, a Republican, was selected to serve as NCUA chairman by President Donald Trump last month, although Hauptman’s tenure on the board is set to end in August.

Credit Union trade groups have already argued that the agency needs to keep its independence. In fact, one industry insider told Tyone the possible consolidation of the financial regulators is the biggest existential threat to the credit union movement since 1981.

Democratic board member Todd Harper, the prior board chairman, said consumers and credit union members need to remember that no one has ever lost even a penny of money insured by the NCUA.

“That hasn’t changed, that’s not going to change and we are not going to take our eyes off the ball,” he said.

“All of us at this table understand that change and uncertainty can be challenging for a number of parties – the credit union system, stakeholders and most definitely NCUA employees. The work each of you does every day keeps our credit union system thriving and keeps our credit union members safe.”

– Kyle Hauptman

Chairman

NCUA