Advocating on the frontlines of financial readiness

Every year, Congress passes the National Defense Authorization Act (NDAA) – a must-pass bill vital to national security. DCUC has long fought to keep the NDAA focused on mission, not marketplace priorities. For example, when big retail lobbyists attempted to slip the Credit Card Competition Act (CCCA) into the NDAA, DCUC sounded the alarm. The CCCA’s government-mandated credit card routing rules would have gutted interchange revenue that defense credit unions use to fund fraud protection, military discounts and reward programs, scholarships, and critical cyber infrastructure – ultimately hurting military families. DCUC made sure lawmakers understood that such unrelated agendas have no place in defense legislation. Likewise, DCUC has pushed back on proposals like an arbitrary national interest rate cap that, while well-intentioned, would cut off credit access for service members with tighter budgets, driving them toward predatory lenders the Military Lending Act was designed to stop. In these fights, DCUC’s message is simple: protect the financial readiness of those who protect our nation.

Over the decades, DCUC has earned its credibility on Capitol Hill by always putting the military community first. Policymakers hear from DCUC through testimony, detailed letters and commentaries on legislation, and face-to-face advocacy. The organization leads coalitions, drafts joint letters, and mobilizes grassroots responses whenever an issue might impact defense credit unions or their members. The results speak for themselves. DCUC has secured numerous “advocacy wins” – from ensuring service members on overseas bases have access to U.S. credit union services, to getting regulatory changes that recognize the unique status of military-focused institutions. Most recently, DCUC helped prevent any changes to the longstanding tax-exempt status of credit unions in a major budget bill, a victory that preserves credit unions’ ability to pour earnings back into member value. “Our proactive advocacy ensured lawmakers heard the credit union story clearly: every dollar of savings, every lower loan cost, every community investment stems from this tax status,” noted Jason Stverak, DCUC’s Chief Advocacy Officer. In short, DCUC stands guard in the policy arena so that credit unions can focus on serving veterans and military families without harmful roadblocks.

Crucially, DCUC’s advocacy is not just about defending against threats – it is also about advancing new opportunities for veterans. DCUC backs initiatives like the Veterans Member Business Loan Act to exempt veteran-owned business loans from certain caps, allowing credit unions to fuel veteran entrepreneurship. It supports the VA Home Loan Awareness Act to ensure veterans know and use their earned home-buying benefits. And DCUC champions practical ideas like allowing more credit unions to accept municipal deposits near bases, boosting local economies and financial options for military communities. This proactive agenda shows DCUC is fighting for veterans’ financial success, not just reacting to problems. “For over 60 years, DCUC and our defense credit unions have stood on the frontlines of financial readiness for America’s military,” DCUC emphasized in a recent call to lawmakers. That frontline advocacy continues today with passion and purpose.

Educating and Empowering Veteran Communities

Advocacy alone is not enough – empowerment through education is another pillar of DCUC’s work. DCUC recognizes that navigating personal finance and benefits can be challenging for service members transitioning to civilian life and for veteran families working toward their financial goals. That is why DCUC develops tailored financial education resources for veterans and military families. For example, DCUC’s Veterans Guide: Understanding Your Benefits is a comprehensive guide created to help veterans make sense of their earned benefits and make informed financial decisions. This guide was even reviewed by the Veterans Benefits Administration to ensure accuracy and value for veterans. Likewise, the Veterans Home Buying Guide walks veteran buyers through the steps of purchasing a home, explaining everything from VA home loans to budgeting for homeownership. These resources serve as roadmaps, giving veterans the confidence and knowledge to achieve major life milestones like buying a house or planning for retirement.

In addition to guides for individuals, DCUC provides tools that help credit unions better serve their military members. Many of DCUC’s educational publications can be customized by credit unions – with their own logo and personal messages – and used in outreach programs. By doing this, DCUC enables each credit union to demonstrate its commitment to veterans in its community, whether by hosting financial literacy workshops or providing these guides as welcome materials for new veteran customers. The focus is always on reinforcing the value of working with member-owned, mission-driven credit unions that understand veteran needs.

DCUC’s educational efforts go beyond printed guides. The Council hosts events like the annual Defense Matters forum and regional sub-council meetings where credit union professionals share best practices on serving military communities. It offers training on topics such as the Service members Civil Relief Act and Military Lending Act compliance, ensuring credit union staff know how to protect military borrowers’ rights. DCUC also shines a light on excellence through its Hall of Honor awards and scholarships that recognize individuals who go above and beyond for military financial wellness. All these initiatives create a knowledge network dedicated to one goal: improving the financial lives of those who wear – or have worn – the uniform of our country.

One standout program is the Veterans Benefits Banking Program (VBBP), a partnership DCUC helped spearhead with the Department of Veterans Affairs. Through VBBP, DCUC connects veterans who might not have bank accounts to safe, reliable, and inexpensive financial services at participating credit unions, especially for receiving VA benefit payments. Credit unions that join VBBP commit to offering free checking accounts for veterans’ VA deposits and personalized assistance to veterans who need help qualifying for an account. This initiative simplifies banking choices for unbanked veterans and helps protect them from predatory alternatives. It’s a perfect example of DCUC’s collaborative approach: identifying a need among veterans and rallying credit unions to fill that gap. Credit unions serve as lifelines when disaster strikes, stepping up for communities in need. Through VBBP and its educational programs, DCUC ensures credit unions can be those lifelines for veterans not just in crises, but every day.

Story continued below…

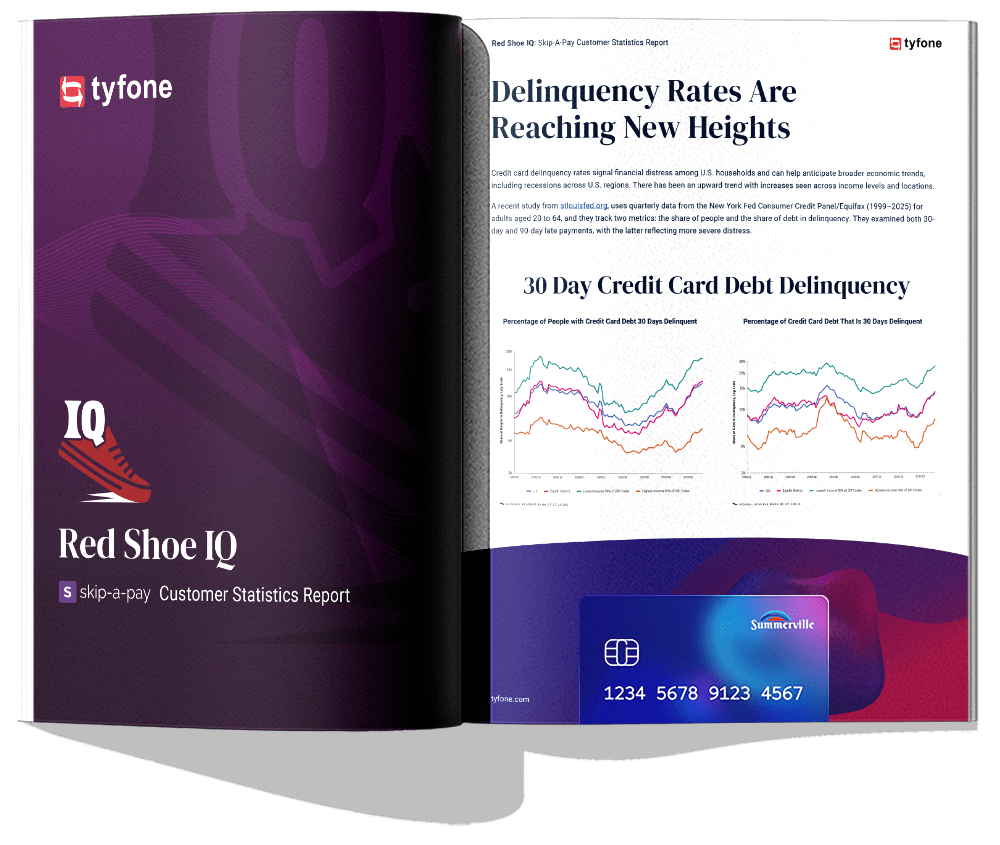

FREE PAMPHLET

Red Shoe IQ:

Skip-A-Pay Customer Statistics Report

Inside this report you will find statistics on 30-day and 90-day debt delinquency across the U.S., comparison of loan skips and yearly revenue from loan skip fees across our customers, loan skips by institution asset size and number of members, and more!

Partnering with Credit Unions to Serve Those Who Served

DCUC’s message to the credit union industry is patriotic and practical: if you want to best serve veterans, partner with the organization that “speaks military” and has been doing it for over 60 years. Credit unions have a special bond with military communities because they operate on a not-for-profit, member-first model that aligns with the military ethos of service. Unlike big banks, credit unions don’t have shareholders – they have members – and every dollar of earnings is reinvested to benefit those members. What does this mean for veterans and service members? It means:

- Lower loan rates on auto loans, personal loans, and mortgages, so military families can save more of their hard-earned money.

- Waived fees or tailored products for deployed service members and their spouses, easing the burden during deployments.

- Financial literacy workshops for young enlistees and transitioning service members, teaching skills from basic budgeting to retirement planning.

- Scholarships and grants for military children and spouses, investing in the next generation of leaders.

- Community investment on installations, from supporting base morale/welfare programs to ensuring there are credit union ATMs and offices where needed.

- Expeditionary cash services for troops in the field – yes, even in deployed locations overseas, defense credit unions work creative solutions to get cash or emergency funds to service members when and where they need it.

All of these life-changing benefits are possible because of credit unions’ mission focus. And DCUC is the champion that makes sure credit unions can continue providing these benefits. By preserving credit unions’ tax-exempt status and fair regulatory treatment, DCUC helps credit unions return billions in direct financial benefits to their members every year. By fighting for sensible defense policies (like ensuring troops have access to “deployable, expeditionary cash” in theater), DCUC supports the very operational readiness of our military. And by uniting credit unions in advocacy, DCUC amplifies the voice of hundreds of institutions so that no credit union serving veterans has to stand alone.

Every credit union in this country has members who are active-duty military, veterans, or their family members. Serving those who served is not just a niche; it is integral to the credit union’s purpose. DCUC helps credit unions fulfill this purpose with excellence. America’s service members, veterans, and their families give so much to our country, and DCUC is proud to represent the credit unions that work for them each and every day. That pride and dedication infuses all of DCUC’s partnerships.

Partner with us today.

Standing the Watch – Yesterday, Today, and Tomorrow

In a very real sense, DCUC and its member credit unions have “stood on the frontlines of financial readiness” for military members and veterans. Just as our troops stand guard to protect the nation, DCUC stands guard to protect their financial well-being. From helping a young service member finance their first car, to ensuring a veteran entrepreneur can get a small business loan, to defending the benefits that make military family life sustainable – DCUC has been there, year after year, mission after mission. DCUC has been here for over 60 years and we’re not going anywhere. This is not a passing cause or a convenient talking point; it is DCUC’s full-time purpose and passion.

As we look to the future, DCUC’s role as the voice for veterans in the credit union industry is more vital than ever. Challenges will surely arise – new scams targeting older veterans, evolving financial technologies, or policy debates that could impact military families’ finances. But veterans and the credit unions that serve them can rest assured that DCUC will be there to meet each challenge. We will continue to “answer the call,” helping military families rebuild after disasters, buy their first homes, launch businesses, and more. DCUC will continue to measure success not in profits but in “mission impact and readiness” – the tangible improvements in the lives of those who served.

The Defense Credit Union Council bills itself as the trusted resource for credit unions on all military and veteran matters.

Disclaimer

The views, opinions, and perspectives expressed in articles and other content published on this website are those of the respective authors and do NOT necessarily reflect the views or official policies of Tyfone and affiliates. While we strive to provide a platform for open dialogue and a range of perspectives, we do NOT endorse or subscribe to any specific viewpoints presented by individual contributors. Readers are encouraged to consider these viewpoints as personal opinions and conduct their own research when forming conclusions. We welcome a rich exchange of ideas and invite op-ed contributions that foster thoughtful discussion.