Digital Bankers Converge on Vegas for Tyfone’s Inaugural Thought Leadership Forum

Tyfone’s first-ever Thought Leadership Forum brought together some of the brightest minds not just in digital banking, but in the greater credit union space, and showcased the power of partnerships.

Tyfone, a leading digital banking provider based in Portland, Oregon, hosted the three-day event at the stunning SouthShore Country Club in Henderson, Nevada, just a short ride from the famous Vegas Strip.

The get-together provided an opportunity for Tyfone’s digital banking partners to network with their peers and also hear the latest in digital banking trends from thought leaders across the industry.

Tyfone’s CEO Siva Narendra kicked the event off by telling the crowd that most tech companies are good at building technology but less so at building relationships.

“At Tyfone, we do both,” he said.

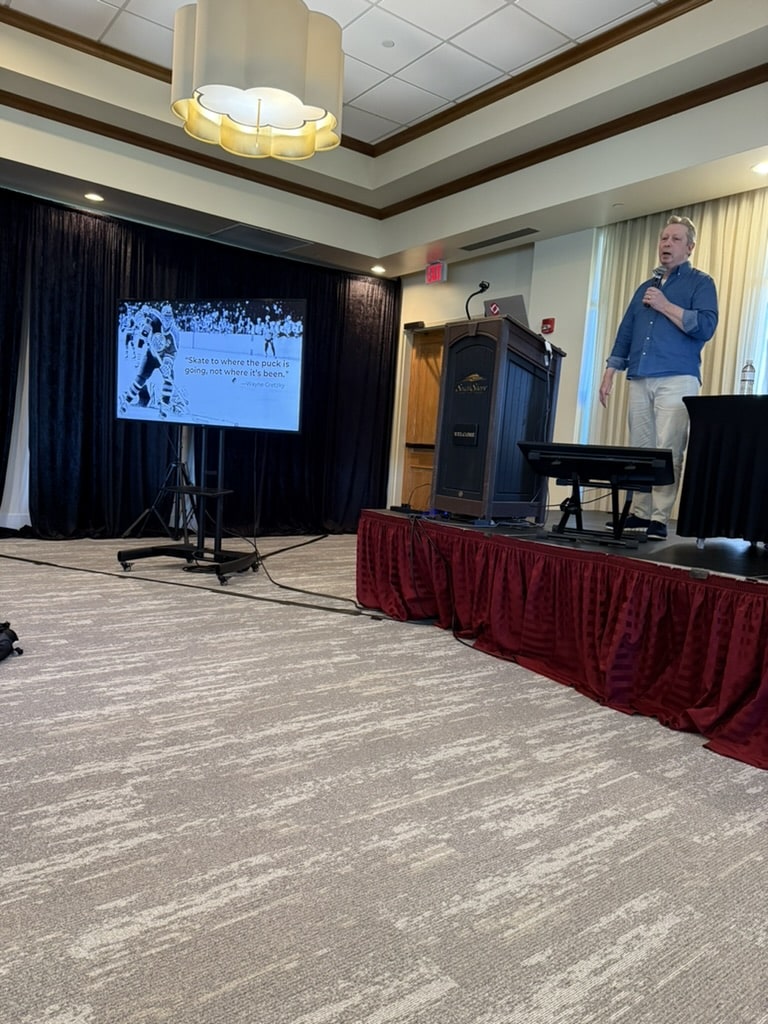

Attendees also heard from keynote speaker Ron Shevlin, Cornerstone Advisors’ chief research officer, who told the group that during the past three years, spending on digital has tripled for U.S. banks and credit unions.

“Overall, I think this is a very good thing,” Shevlin said. “It may be challenging from a budgeting perspective, but I think it represents the importance of digital and I think a lot of our participating financial institutions get that.”

Shevlin said the adoption of mobile deposits during the past three years is up 50%, although a good portion of that was driven by the COVID-19 pandemic. Still, many of the older consumers who were forced into mobile deposits when branches closed have continued to utilize it, he said.

Among several thought-provoking panel discussions at the event was a session on instant payments, and specifically FedNow.

The Federal Reserve’s instant payments network, FedNow, launched in 2023, and Tyfone is the third largest originator on the network.

Minal Gupta, EVP of Operations at $10 billion-asset Star One Credit Union in Sunnyvale, California, said fraud is a concern with instant payments, but the institution has seen “a fraction” of fraud using FedNow compared to other channels.

Tyfone partnered with Star One to initiate the first-ever transaction on FedNow, just moments after the platform’s go-live.

Other group discussions included information about Payfinia’s Instant Payments Xchange, Tyfone’s Quick Pay and Skip-A-Pay products as well as customer success stories.

But the event was not all about work.

Attendees also had plenty of networking opportunities and were also treated to an on-site “casino night” event as well as a dinner at the exciting Marrakech, just off the Strip.

Marcell King, Tyfone’s Chief Commercial Officer, later directed a discussion on intelligent lifecycle banking.

“We all want our kids to do better than we’ve done, so we have to give them the right tools,” he said.

Moments later, Marcell’s family surprised him by showing up at the event to celebrate his birthday!

“Tyfone continues to foster client collaboration and understand customer needs. Seeing and feeling Tyfone’s culture was impactful as a client,” said Regena Hull, Director of Digital and Retail Services for Emprise Bank in Wichita, Kansas.

Stay tuned for more information about Tyfone’s second-annual Thought Leadership Forum, coming in 2025!