Bank sale fails to materialize, so Mass. CU to merge with in-state peer

Losing money, the $155 million-asset Arrha Credit Union in Springfield, Massachusetts, will merge into the $2.2 billion-asset BrightBridge Credit Union.

BrightBridge Credit Union in Lawrence, Massachusetts, will expand its field of membership to serve three additional counties in the state as well as two in Connecticut through its planned merger with Arrha Credit Union.

The $2.2 billion-asset BrightBridge, which was formerly known as Merrimack Valley Credit Union, will widen its footprint into the Hampden, Hampshire and Franklin counties in Massachusetts and Hartford and Tolland counties in Connecticut.

If the member vote and regulatory approvals are successful, the merger will become official in early 2026.

“Arrha Credit Union has a long-standing reputation for supporting its members with integrity, care and genuine down-to-earth service. Our partnership allows us to build upon that legacy while investing in future growth and innovation,” said BrightBridge President and CEO John Howard in a press release.

The $155 million-asset Arrha in Springfield, Massachusetts, earlier this year was involved in a proposed acquisition by Pittsfield, Massachusetts-based Pittsfield Co-operative Bank, S&P Global Market Intelligence reported.

Story continued below…

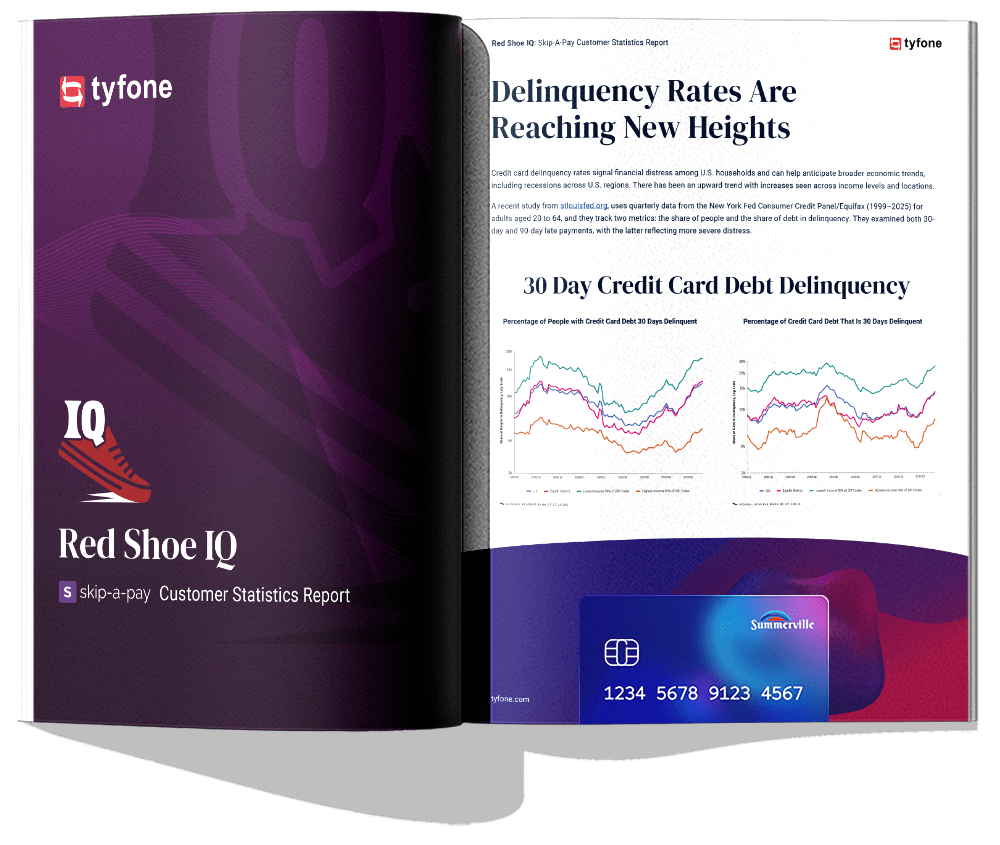

FREE PAMPHLET

Red Shoe IQ:

Skip-A-Pay Customer Statistics Report

Inside this report you will find statistics on 30-day and 90-day debt delinquency across the U.S., comparison of loan skips and yearly revenue from loan skip fees across our customers, loan skips by institution asset size and number of members, and more!

The credit union’s board approved the merger proposal during a special meeting held in late November, Pittsfield Co-operative Bank’s president and CEO J. Jay Anderson told S&P.

It is unclear why that deal failed to materialize.

The BrightBridge/Arrha tie-up will result in an organization with 23 branches, nearly $2.4 billion of assets and approximately 125,000 members.

“Together, we’ll be stronger and better equipped to serve our members’ evolving financial needs. We look forward to working with the BrightBridge team to ensure a smooth transition for all,” said Michael Ostrowski, President and CEO of Arrha Credit Union.

The press release did not indicate what Ostrowski’s future is with the organization as BrightBridge’s Howard will lead the combined company.

The National Credit Union Administration approved 35 mergers during the first quarter of 2025 compared to 26 a year earlier, according to the agency’s Merger Activity and Insurance Report.

BrightBridge has 115,000 members and earned roughly $1.5 million in the first quarter of 2025, a 40% decrease compared to a year earlier, according to call report data from the NCUA.

Arrha lost $75,000 in the first quarter after reporting losses of nearly $185,000 in 2024.

“We believe this partnership is exceptionally beneficial to our members, our team members and to our community.”

– Michael Ostrowski

President and CEO

Arrha Credit Union