The relentless pursuit of growth in credit unions

For too long, credit unions have underestimated their potential.

In a time of historic disruption—where traditional banks are retreating, where AI and digital-first platforms redefine member service, and where the tax advantage has been reaffirmed—it is no longer enough to survive. We must dominate.

I believe credit unions can capture 20% of the community banking market. I’ve seen it happen. At Bethpage Federal Credit Union, we set an aggressive goal: double our asset size every five years. This wasn’t a branding exercise—it was a strategic necessity. Growth isn’t optional in hyper-competitive environments. It’s the only way to stay relevant, attract talent, and reinvest in member value.

But here’s the truth: growth demands a cultural shift.

It means running your credit union like a high-performing business. It means treating strategy as sacred. I remember the first time we missed our quarterly growth goal at Bethpage. We didn’t rationalize it away. We stopped everything. I gathered the entire management team and said: “Nothing else matters until we fix this.” That moment redefined us. We never missed another strategic goal again.

We built a brand that beat banks on price and service. Our expense ratio dropped from 2.5% to 1.79%—freeing capital to invest in tech, talent, and innovation. We weren’t the biggest. But we were the most relentless. We measured everything. We studied our competitors.

We attacked their weaknesses. We embraced scale—not just for efficiency, but for strategic flexibility. We became the number 2 retail banking brand in the most competitive banking market in the country.

Growth became our center of gravity.It replaced stock as the driver of our business.

Story continued below…

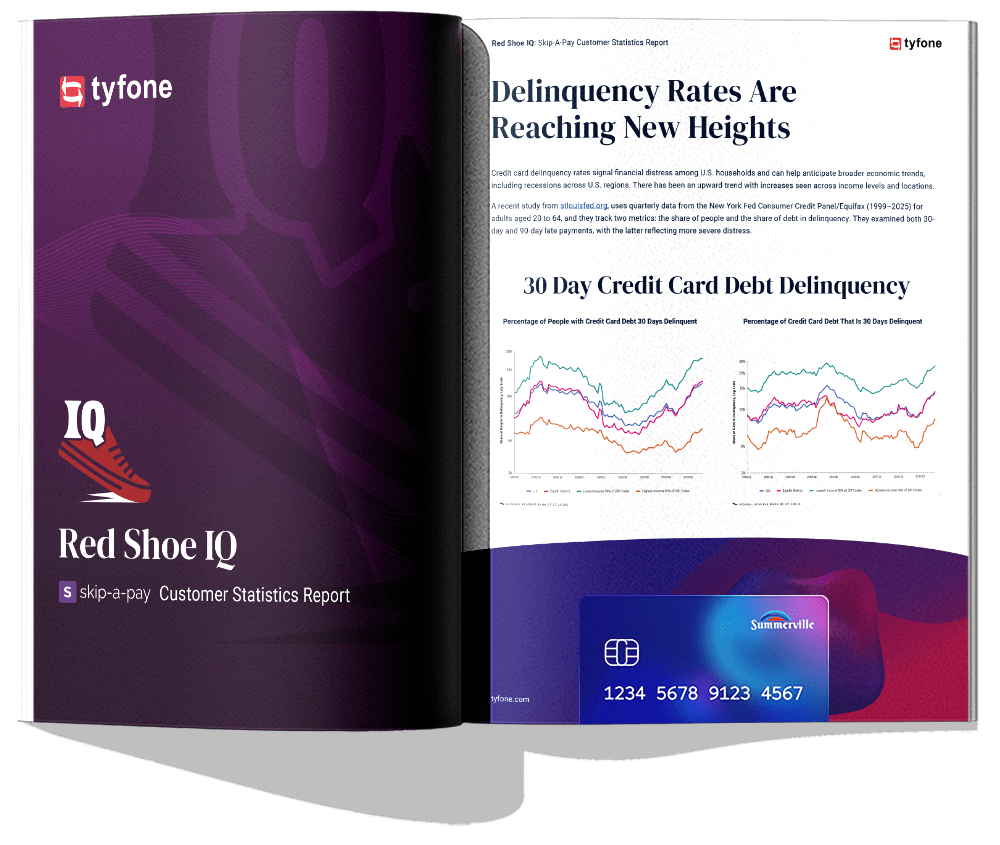

FREE PAMPHLET

Red Shoe IQ:

Skip-A-Pay Customer Statistics Report

Inside this report you will find statistics on 30-day and 90-day debt delinquency across the U.S., comparison of loan skips and yearly revenue from loan skip fees across our customers, loan skips by institution asset size and number of members, and more!

Leadership is the differentiator.

The CEO must be the chief strategist, the chief motivator, and the chief learner. You can’t build a culture of high performance without leading one. That’s why I tell the next generation of credit union leaders: if you want to win, you must stretch your teams, align every function to growth, and build a performance engine that never stops iterating.

I’ve worked in credit unions from $25 million to $6 billion (Four Leaf is now approaching $15B). I’ve led during booms and during personal battles. And I’ve come out the other side with one unwavering belief: the credit union model—cooperative, purpose-driven, member-first—can outcompete any bank, any fintech, any platform. But only if we act like it.

Now is the time to get aggressive.

To use our data. To partner with fintechs. To build cultures of speed, service, and scale. To be bold enough to say: yes, 20% market share is within reach—and we’re the ones to lead the way.

Before joining PARC Street Partners, Kirk Kordeleski was a partner at OM FinancialGroup for four years. Prior to that, he was CEO of $13.5 billion-asset Bethpage FCU in New York for 15 years.

Disclaimer

The views, opinions, and perspectives expressed in articles and other content published on this website are those of the respective authors and do NOT necessarily reflect the views or official policies of Tyfone and affiliates. While we strive to provide a platform for open dialogue and a range of perspectives, we do NOT endorse or subscribe to any specific viewpoints presented by individual contributors. Readers are encouraged to consider these viewpoints as personal opinions and conduct their own research when forming conclusions. We welcome a rich exchange of ideas and invite op-ed contributions that foster thoughtful discussion.